Table of Contents

What Are Finances? Clear Definition

Most definitions say finance is “money management” — accurate but superficial. The deeper definition is:

The key parts are:

-

Allocation — choosing where capital goes

-

Time — today versus the future

-

Uncertainty — risk of not achieving outcomes

-

Value — trade-offs between growth and safety

These elements appear in all financial decisions, whether personal or macroeconomic (see IMF and World Bank frameworks on resource allocation).

Why Finance Exists: The Core Problem It Solves

Finance exists because resources are limited — and the future is unpredictable.

The Core Constraints

| Constraint | Example |

|---|---|

| Limited Income | Personal salary |

| Limited Capital | Business cash |

| Uncertain Future | Market risk |

| Opportunity Cost | Missed alternatives |

Opportunity cost — the value of the next best alternative — is central. Choosing one financial path means giving up another.

Visual – Time Value of Money Chart

This chart illustrates why money today is worth more than tomorrow:

The concept of the time value of money is foundational in finance and is taught in programs like those from the CFA Institute and in college texts (e.g., Brealey, Myers & Allen, Principles of Corporate Finance).

The 3 Domains of Finance (Unified by One Framework)

Finance operates in three major domains:

Personal Finance

Key responsibilities include:

-

Budgeting

-

Saving

-

Investing

-

Managing debt

-

Insurance

-

Retirement planning

Personal Finance Checklist

| Area | Questions to Ask |

|---|---|

| Budget | Are expenses less than income? |

| Savings | Do I have a 3–6 month reserve? |

| Debt | Is debt controlled and productive? |

| Investing | Am I diversified? |

| Protection | Do I have adequate insurance? |

Why this matters: Personal finance decisions affect lifetime outcomes — retirement security, home ownership, education funding — and are fundamentally allocation problems with risk and time dimensions.

Corporate Finance

Corporate finance focuses on how organizations manage funds to create value.

Corporate Finance Breakdown

| Component | Core Question |

|---|---|

| Capital Structure | Should the company use debt or equity? |

| Capital Budgeting | Which projects maximize value? |

| Working Capital | Are short-term resources enough? |

| Risk Management | How are risks hedged? |

Companies don’t just “manage money.” They optimize capital structures to balance growth and solvency. For example:

-

Apple Inc. holds large cash reserves but also issues debt for strategic flexibility.

-

Tesla, Inc. uses equity to fund aggressive expansion.

These decisions are justified using tools like Net Present Value (NPV) and Internal Rate of Return (IRR), which are taught in Harvard Business School finance courses.

Public Finance

Public finance examines how governments manage money.

| Public Finance Function | Example |

|---|---|

| Taxation | Income, sales, property tax |

| Public Spending | Infrastructure, defense, services |

| Borrowing | Government bonds |

| Monetary Coordination | Interest rate policy |

Institutions such as the Federal Reserve (US central bank) and international organizations like the International Monetary Fund (IMF) provide analysis frameworks used worldwide.

The 3 Core Questions in Every Financial Decision

Across all domains, finance boils down to three questions:

| Question | Application |

|---|---|

| Where does capital come from? | Income, loans, taxes, equity |

| Where should it go? | Consumption, projects, investments |

| How is risk managed? | Insurance, hedging, diversification |

This simple framework aligns financial strategy from the personal level up to macroeconomic policy.

Time Value of Money: The Engine of Finance

The time value of money (TVM) explains why finance decisions always involve timing.

TVM Equation (simplified):

Illustrative Example

| Scenario | Present Value | Rate | Years | Future Value |

|---|---|---|---|---|

| Savings | $1,000 | 5% | 5 | $1,276 |

| Investing | $1,000 | 8% | 10 | $2,159 |

| Aggressive | $1,000 | 12% | 10 | $3,106 |

This chart shows exponential growth from compounding — a core concept taught in finance programs from CFA Institute and university courses.

Risk vs Return: The Central Trade-Off

Finance is about balancing risk and return.

| Asset Class | Expected Return | Risk/Volatility |

|---|---|---|

| Cash | Low | Very Low |

| Bonds | Moderate | Low |

| Equities | Higher | Moderate |

| Alternatives | High | High |

Modern Portfolio Theory (MPT), developed by scholars like Harry Markowitz, formalizes this trade-off and is widely respected in academic finance (sources: Journal of Finance, Nobel lectures).

Finance vs Economics vs Accounting

Many people confuse these disciplines. Here’s how they differ:

| Discipline | Core Focus | Time Orientation |

|---|---|---|

| Accounting | Recording transactions | Past |

| Finance | Decision making under uncertainty | Present/Future |

| Economics | Market behavior and systems | Macro/Micro |

Accounting tracks what happened. Finance decides what should happen next.

How Finance Affects Everyday Life

Finance isn’t abstract. It impacts:

Cost of Borrowing

If central banks raise interest rates:

-

Borrowing costs go up

-

Loan payments rise

-

Business expansion slows

(Source: Federal Reserve monetary policy summaries)

Inflation

Inflation erodes purchasing power:

-

$100 today buys more than $100 in five years

-

Inflation expectations drive wage and price adjustments

(Source: World Bank inflation data)

Investments

Stock markets fluctuate due to:

-

Earnings expectations

-

Risk sentiment

-

Macro conditions

(Source: IMF World Economic Outlook)

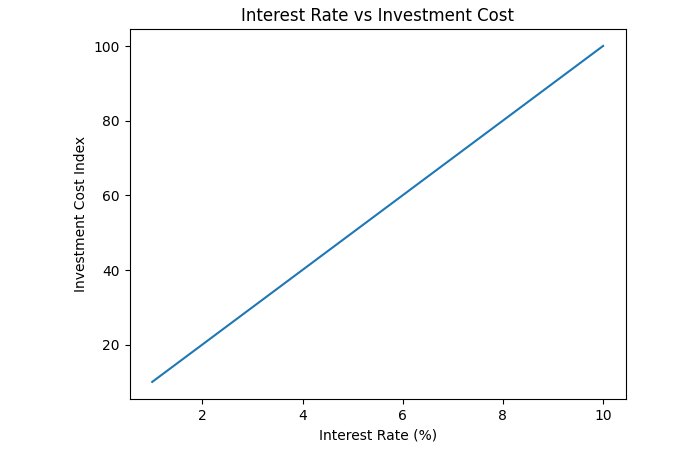

Visual – Interest Rate vs Investment Cost Chart

This chart illustrates how rising rates increase the cost of capital — a principle central to both corporate and personal finance.

Modern Finance: Trends and Evolution

| Innovation | Impact |

|---|---|

| FinTech | More access to financial services |

| AI in Finance | Algorithmic trading, risk models |

| ESG Investing | Sustainability factors |

| Decentralized Finance (DeFi) | Blockchain-based lending |

Companies like PayPal and BlackRock exemplify these shifts — showing how finance adapts without changing core logic.

Common Myths vs Reality

| Myth | Reality |

|---|---|

| Finance is only for wealthy people | Everyone uses finance |

| Investing is gambling | Structured risk analysis reduces uncertainty |

| Debt is always bad | Use strategic debt to grow |

| Finance requires advanced math | Understanding concepts matters more than equations |

Final Framework Summary

At its heart, finance is about making decisions when resources are scarce and the future is uncertain.

It’s not just money plugged into budgets — it’s strategic allocation:

-

Considering time

-

Evaluating risk

-

Comparing alternatives

-

Maximizing long-term value

High-Authority Resources to Learn More

| Source | Focus |

|---|---|

| International Monetary Fund (IMF) | Macro policy and public finance |

| World Bank | Global finance and development |

| Corporate Finance Institute (CFI) | Practical finance skills |

| CFA Institute | Investment and capital markets education |

| Federal Reserve | Monetary policy and financial system |

Conclusion

Finance underpins every economic decision — from personal savings to national budgets. Understanding it as a framework for allocating capital under uncertainty changes how you make choices, manage risks, and plan for the future.